Have you ever dreamed of an app to plan your trips, pay for your groceries, get food delivered or take out a loan? Unknown in the West, Didi, Grab, Gojek, WeChat… super-apps are more than present in Asia. Used by millions of people on the continent, the West is becoming more and more interested in these applications that group all services on a single app. But can this model really work in Europe and North America? Does the mobility industry have a role to play? In any case, the race to the super app has been on for a few years now. Let’s zoom in on these applications that are revolutionizing the way we use our phones.

Definition of super apps

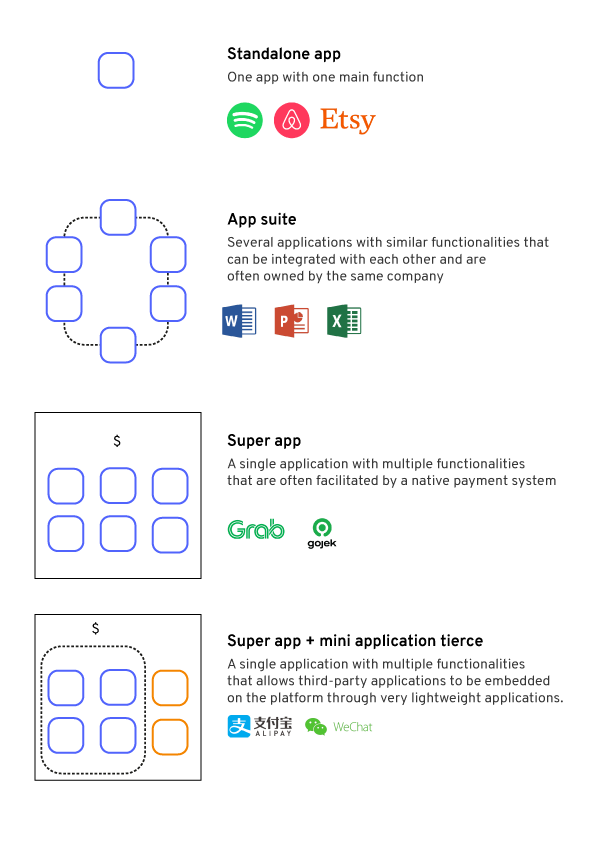

What is a super app? A super app is simply an application that gathers on its platform a multitude of features and services, often through the payment system of a single company. But there are also super apps that work as a real portal between many mini-apps. Those miniapplications are designed and developed to integrate this “portal” application.

The biggest players, such as WeChat and Alipay in China, each have nearly 1 billion users. Therefore, this is a huge opportunity for the developers of these applications. But why and how can we explain the reasons for its success in Asia? Why has this model not yet arrived in Western countries? What opportunities do these applications represent for the mobility industry?

The reasons for the success of super applications

According to the emerline.com blog, there are 4 reasons for the success of these applications. These reasons are partly related to the culture, common to many Asian countries.

The mobile experience

According to Statista, Asia is globally a mobile addicted continent. In fact, 81% of Indonesians and 61% of Chinese use their cell phones only to consult travel sites. In Germany and France, this figure was 35% and 34%. Moreover, the smartphone market in Asia is much larger and cheaper, with many brands present on the market. Asia has little or no experience of the first use of the Internet, which was on the computer. It is because of the high usage of the smartphone, compared to computers, that the storage limit in phones has forced the demand and need for these super apps, allowing access to all services without installing several applications.

A population that uses banking very rarely.

According to KPMG, 73% of Southeast Asians are unbanked. This population prefers online payments or the use of cash. In China, for example, few stores accept credit cards, but all accept payments via WeChat or Alipay. In South Asia more generally, the use of cash is so widespread that applications such as Grab have immediately enabled cash payments.

A homogeneous market

Most Asian countries have a common culture. This has an impact on the market, as these similarities allow companies to be present in different countries without worrying about cultural differences. It is therefore easier to enter this market if the application is already present in a neighboring country.

Important government support

The popularity of these super applications is also linked to the help that governments provide. Indeed, super applications are also an opportunity for these Asian governments to mass digitally connect their population. In China for example, many public services are accessible on WeChat or Alipay.

The example of Grab, a Singaporean startup

Founded in 2012, Grab was originally an app connecting drivers and customers. Faced with competition from other applications such as gojek, already present in Indonesia and threatening to take market share from Grab in other countries, the company quickly took the turn of the super-app. Indeed, it now offers services such as food delivery, a virtual wallet, a bank or an insurance.

Currently, the company operates in 8 countries: Malaysia, Singapore, Cambodia, Indonesia, Myanmar, Philippines, Thailand and Vietnam. The company is valued at $40 billion and has nearly 187 million users.

Super apps in Europe and North America

The success of super applications is attracting. Especially in Europe and North America, where there is no super app as such. But many companies have entered the super app race, such as Uber, Bolt or Paypal.

But the entry of super apps on the Western market is facing some difficulties. First of all, the use of super apps is primarily cultural. If in Asia, the use of a single application with a certain monopoly for a majority of services is not a problem, this is not the case in the West. Most of these countries are fundamentally attached to freedom and the United States, for example, was built entirely on this principle.

Aussi, ce type d’application est difficilement en conformité avec la RGPD ou toutes les lois qui concerne la récolte de données et le traitement de la vie privée. En effet, plus les possibilités sont grandes dans une application, plus la récolte de données est importante. Cette récolte de données peut constituer un réel frein pour les Européens et le monde occidental en général. La majorité n’est pas prête à laisser tomber sa “vie privée” au profit de la praticité.

Also, this type of application is hardly in compliance with the GDPR or all the laws that concern data collection and privacy treatment. Indeed, the more the possibilities are big in an application, the more the data collection is important. This data harvesting can be a real brake for Europeans and the western world in general. The majority is not ready to give up their “privacy” for the sake of practicality.

Super apps and mobility

Many of the super apps started out as mobility businesses, such as cabs or ride-hailing. And it seems that this pattern is being replicated in the West. Like Uber, which, in addition to its traditional business (and more recently, food delivery) offers in some cities the possibility of taking public transport. An option that greatly simplifies mobility by centralizing many options for getting around. Add to that, a native payment system and a social network, and Uber will have almost all the keys in hand to become a great app. But for this, it is necessary to force the collaboration between several giants who also want to develop their own super apps, like Facebook or PayPal. As for MaaS application development, collaboration is essential to succeed in developing the ideal application. But this is not necessarily an easy model to implement in a mostly individualistic society.

Other players such as Bolt, also want to enter the super app race. Originally a micro-mobility company, it recently raised $600 million. This round was an opportunity for the company to affirm its desire to become the next super app in Europe. Its mobility services now extend from VTC to scooters and bikes. It also offers food delivery and has recently entered the food delivery sector with Bolt Market.

The race for the super app is therefore on in Europe and North America. But for cultural reasons, it seems obvious that this model will not be entirely copied, but adapted to Western markets. It remains to be seen who will be the first to officially launch its super app.

To go further, download for free our in-depth analysis of 10 major MaaS apps. Transport operators, intermodal trip planning, bus ticket purchase,… Discover how they succeed in covering all mobility needs on a single platform.